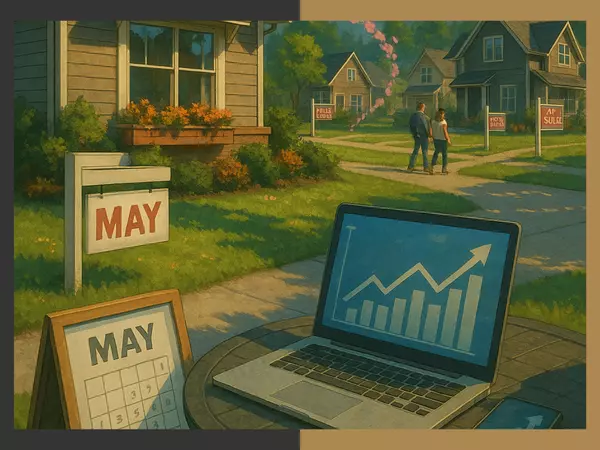

Why Buyers Are Still Moving Forward—Even as Rates Rise

Mortgage rates just hit their highest point since January—something that, at first glance, should have cooled the housing market.

But that’s not what’s happening.

According to the Mortgage Bankers Association, purchase applications rose 2% last week, and are up 18% compared to this time last year. So what’s driving that momentum?

Today’s Buyers Are Doing the Math

We’re seeing a new kind of buyer emerge—one who’s looked at the numbers and decided that a slightly higher monthly payment is worth the long-term benefit. Whether it’s locking in a home they truly love or capitalizing on a deal that didn’t exist last year, serious buyers are making moves.

It’s not just happening at the entry level either. Across all price points, buyers are stepping in—when the property (and the price) make sense.

Sellers Are Adjusting Too

This isn’t just about buyer activity—it’s also about seller motivation.

With inventory up 32% and 38% of listings seeing price cuts (source: Altos via HousingWire), we’re watching sellers become more realistic. That doesn’t mean homes are being given away, but it does mean:

-

More room for negotiation

-

Greater flexibility on timing

-

And in some cases, sellers willing to cover part of the buyer’s closing costs

This kind of give-and-take is bringing more deals together—even with rates higher than they were a few months ago.

What This Means for You

If you’ve been on the fence, it might be worth re-evaluating. The market is shifting in real time, and opportunities exist for both buyers and sellers who are prepared, informed, and ready to move when the moment is right.

Have questions? Want to know how this affects your plans? I’m happy to run the numbers or talk strategy—just reach out.

Categories

Recent Posts